An insurable risk is a risk that can be transferred to an insurance company through an insurance contract. It is a risk that is uncertain, fortuitous, and can be financially quantified. Which statement regarding insurable risk is not correct?

The answer is: An insurable risk is a risk that is certain to occur.

Definition of Insurable Risk

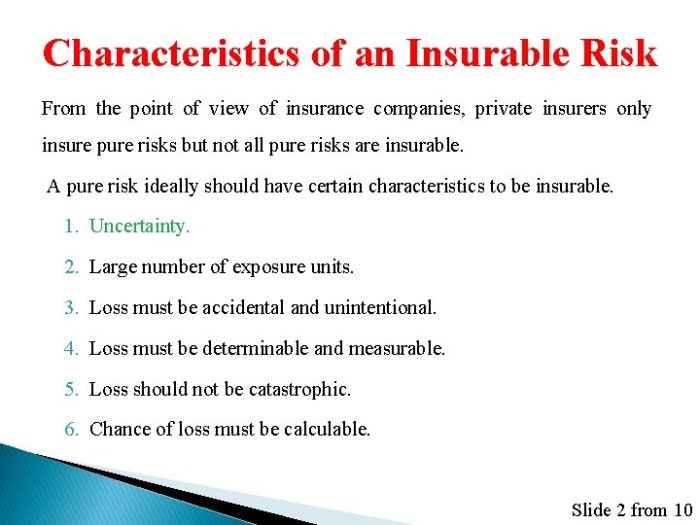

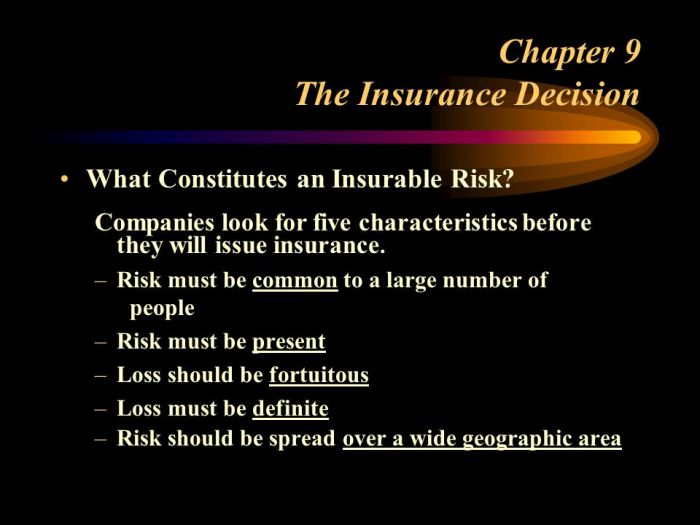

Insurable risk refers to the possibility of a future event that may cause financial loss or damage and can be insured against by transferring the risk to an insurance company. Insurable risks are characterized by their:

- Definite Loss:The loss or damage must be certain to occur, although the exact timing may be uncertain.

- Fortuitous:The event must be unexpected and unintentional, not resulting from the insured’s deliberate actions.

- Measurable:The financial impact of the loss or damage must be quantifiable to determine the appropriate insurance coverage.

Characteristics of Insurable Risk, Which statement regarding insurable risk is not correct

Insurable Interest

Insurable interest refers to the legal right or financial stake that an individual or entity has in the subject matter of insurance. It establishes the insurability of the risk and ensures that the insured has a genuine reason to obtain insurance coverage.

Fortuity

Fortuity is a fundamental principle of insurable risk. The event leading to the loss or damage must be accidental and unpredictable. Intentional acts or willful negligence are typically excluded from insurance coverage.

Indemnity

The principle of indemnity governs the settlement of insurance claims. The insurance company aims to restore the insured to the same financial position they were in before the loss occurred, but not to profit from the event.

Questions Often Asked: Which Statement Regarding Insurable Risk Is Not Correct

What is an insurable risk?

An insurable risk is a risk that can be transferred to an insurance company through an insurance contract.

What are the key characteristics of an insurable risk?

The key characteristics of an insurable risk are that it is uncertain, fortuitous, and can be financially quantified.

What is the difference between an insurable risk and an uninsurable risk?

An insurable risk is a risk that can be transferred to an insurance company through an insurance contract. An uninsurable risk is a risk that cannot be transferred to an insurance company through an insurance contract.